A Better Way To Borrow

The Aski Capital Solution

Aski Capital Inc. (Aski) is a unique financial services company that has developed a socially-responsible and financially-sustainable alternative to payday loans. Aski provides borrowers rapid access to short-term loans regardless of credit history at an APR that is a fraction of the cost of a typical payday loan.

NEWS

HOLIDAY SPECIAL OFFER!

November 3rd to December 19th,2025

Eligible borrowers may be qualified for NET PLUS NET!

5 to 12 pay periods

For more information, please contact us

Employer Benefit Loans

Dear Valued Client:

At Aski Capital Inc. we know how important it is to be able to access the services you need. Now, more than ever, lean on us to alleviate your financial strain.

We offer low interest, short-term employer benefit loans. Applicants may be eligible to borrow their bi-weekly pay + 50%. This comes with the added benefit of flexible and individually customizable repayment terms ranging anywhere from 5 to 8 pay periods. Whatever works best for your current situation!

You can apply for an employer benefit loan from the safety of your own home, with the option of signing documents electronically for your safety and convenience.

We’re here to help! Don’t hesitate to reach out.

Clients who wish to access our services are encouraged to apply at www.askicapital.com or via fax 204-987-7188.

Call us now at 1-877-987-7180 to determine your eligibility or to see if your organization is an existing partner with Aski Capital.

Our current hours of operation are Monday to Friday 9 a.m. to 5 p.m. We are closed for lunch from 12-1 p.m.

If you have any questions, please call our office at 1-866-987-7180 or 204-987-7180.

Sincerely,

Aski Capital Inc.

The Facts

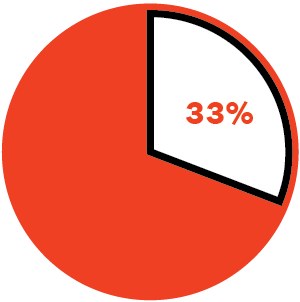

One third of Canadians are unable to meet their financial obligations.

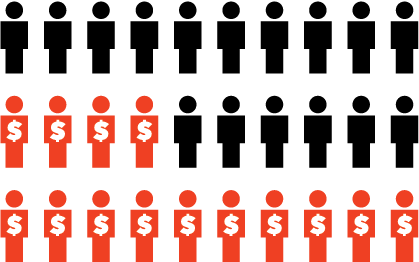

Nearly half of Canadians are within $200 of inability to pay bills.

47% of Canadian workers live paycheque to paycheque.

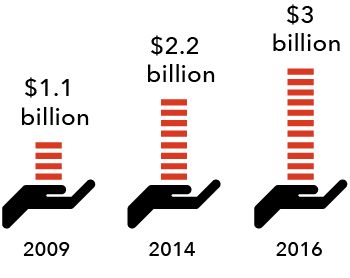

In response, there has been a proliferation of non-traditional lending solutions. Many are unregulated and create recurring use due to the extremely high cost of borrowing and onerous repayment terms. Payday Loans (PDLs) are the most common.

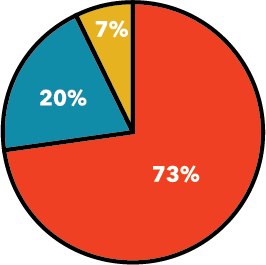

Myth: Only low-income Canadians use Payday Loans.

Fact: 27% of Payday Loan users have an annual household income of over $80,000, and 7% make over $120,000.

- 73% < $55,000 annual household income

- 20% < $80,000 annual household income

- 7% < $120,000 annual household income

Myth: Payday Loans are used for unnecessary luxuries

Fact: 86% of PaydayLoans are used to pay for necessary expenses.

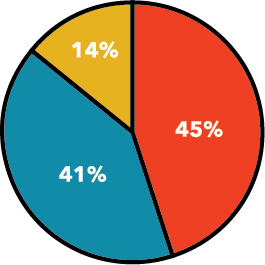

- 45% use it for unexpected necessary expenses (e.g. car repairs)

- 41% use it for expected necessary expenses (e.g. utility bills)

- 14% use it for other expenses

What is an Employee Benefit Loan?

Through our Employer Benefit Lending Program, Aski provides a low‐cost and responsible alternative to high‐cost lenders.

Learn MoreHow can my organization become an Employer Partner?

As an employer you can make a real difference by providing access to the resources your employees need to build their futures and get where they want to be.

Learn MoreHow can I apply for an Employee Benefit Loan?

If your employer is currently partnered with Aski, you can access an application for an Employee Benefit Loan or learn more here.

Learn More

I really like [the Aski Program] because it gives me the opportunity to get funds when there is an emergency.ASKI CUSTOMER / 2017 Third Party Survey, Terrapin Social Finance